Mentioned in the “Lifes Changes” blog.

Guaranteed Auto Protection (GAP) is coverage that covers the difference in what you owe on your vehicle and what it is worth at the time of a total loss accident.

GAP can be extremely beneficial if your vehicle is declared a total loss.

Unless you have guaranteed replacement coverage (also known as new car replacement), most insurance policies will only give you the fair market value of your vehicle at the time of loss.

What happens if you owe a lot more than the fair market value of your vehicle to your financing company?

If you do not have GAP coverage you will still be paying on a vehicle that no longer exists.

Here’s a math problem for you:

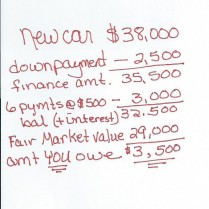

- You buy a brand new car that you paid $38,000.

- At purchase you paid $2,500 as a down payment leaving $35,500 as financed debt.

- Six months later you are involved in a covered comprehensive or collision accident which totals your vehicle.

- During this time you have made six payments of $500, paying off $3,000 of debt but leaving you with $32,500 financed.

- Since vehicles can dramatically lose value over a short amount of time the fair market value of your vehicle is only $29,000.

- This leaves you with $3,500 of financed debt you will still be required to pay (7 months of payments to your lender).

GAP will pay this difference for you so you are not stuck with making payments on a vehicle you no longer have.

GAP will pay this difference for you so you are not stuck with making payments on a vehicle you no longer have.

GAP is available on both financed and leased vehicles (typically required on leased vehicles, and part of the lessor’s acquisition charge).

This coverage may be a good option for you if you are purchasing a new/used vehicle with little to no money down or if you are “upside down” with your trade in on the existing financing.

Any of our licensed insurance agents at Barr’s Insurance are only a phone call away to discuss this coverage with you! Give one a call at 888.813.7500 to add this onto your insurance policy to cover your current model year vehicle. Also visit our website at http://bit.ly/1sZb4IS to see how we can help you get the best auto coverage available.

Blogger, Kerri Yashinski

Barr’s Personal Lines Account Manager